capital gains tax budget news

By Naomi Jagoda - 072421 500 PM ET. Select Popular Legal Forms Packages of Any Category.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021.

. Fact Sheet How the Capital Gains Tax Supports Communities August 03 2022. The House proposal would also. The government wants to boost revenue from the capital market to support welfare activities the report said.

Dividends and capital gains are also tax free. Super-wealthy estates owe a 40 federal estate tax under current law on values exceeding 117 million for. With NIIT Net Investment Income Tax added in individuals will face a tax hike.

The capital gains tax would go into effect Jan. It was announced that long-term capital gains beyond Rs 1 lakh from stocks equity funds. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely.

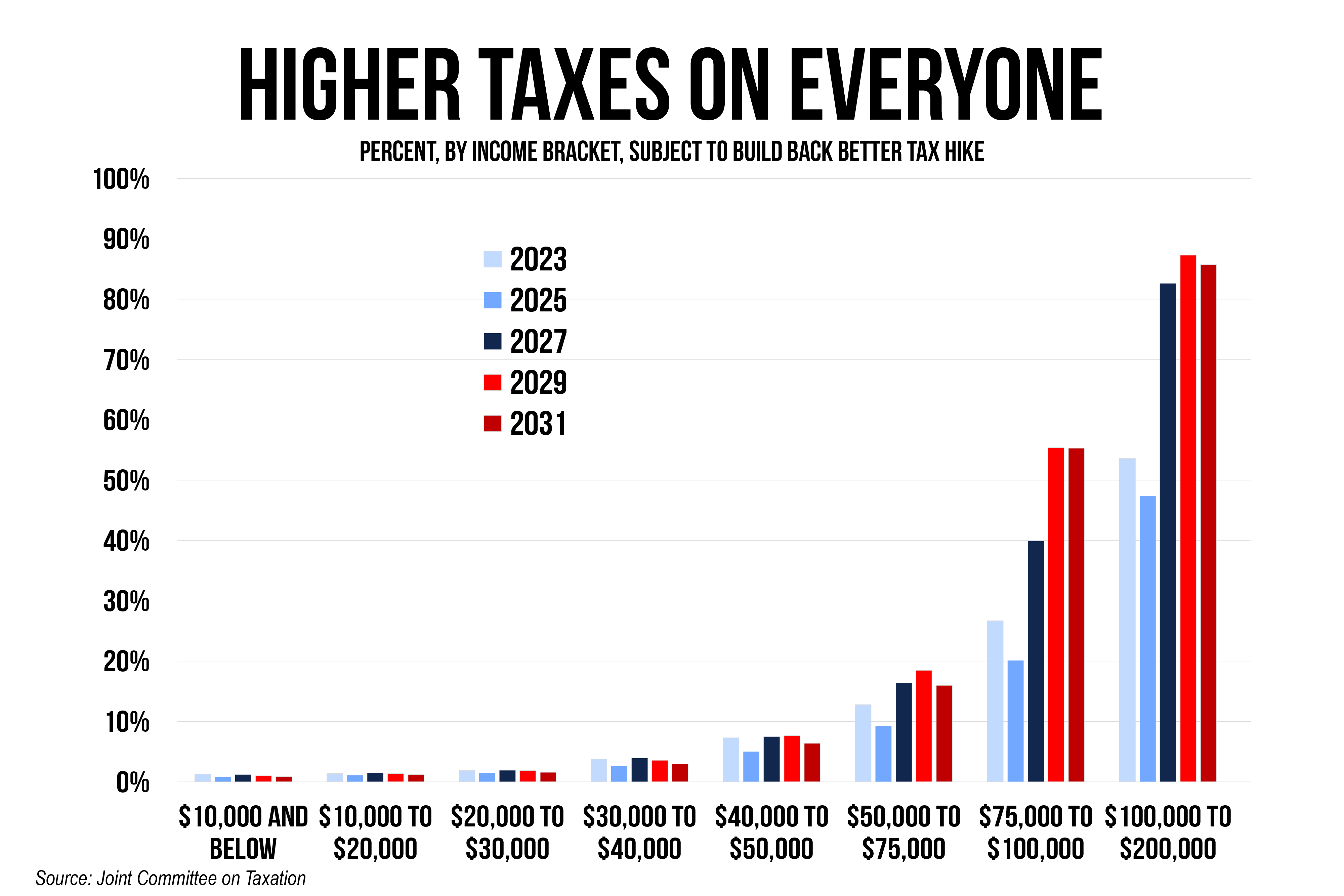

The measure adds a 7 tax on capital gains above 250000 a year such as profits from stocks or business sales. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gains. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

This is expected to benefit. Major income tax changes in last 10 years and how they have impacted your investments. 1 2022 with the first tax payments due April 15 2023.

EISs offers the same 30pc relief if held for three years but savers can invest 1m or 2m into knowledge-intensive companies. Its could bring in 11 billion in new. January 27 2022 1244 PM IST.

Exceptions include the sale of real estate livestock and small family-owned businesses. The surcharge on long-term capital gains LTCG tax has been capped at 15 for all listed and unlisted companies finance minister Nirmala Sitharaman said. Last year the Legislature passed and Gov.

Jay Inslee signed into law a capital-gains tax aimed at the states wealthiest residents. Congressional Hearing on Economic Disparity August 10 2022. Blog Post Seattles millionaires would profit most if schools lose funding from capital gains tax By Andy Nicholas July 05 2022.

All Major Categories Covered. But if you sell a debt mutual fund. Once again no change to CGT rates was announced which actually came as no surprise.

The Finance Minister Nirmala Sitharaman announced the capping of the surcharge on the long term capital gains payable on capital assets at 15 percent. Venture capital investors and startup founders are likely to benefit from a tax tweak announced in Budget 2022-23. The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35 trillion budget.

Jay Inslees proposed budget had recommended a capital-gains tax with a 7 percent rate that would have raised about 800 million in the 2017 fiscal year. The report cautions against tax policies promoted by President Trump and Republicans like. 19 hours agoAlthough just 05 percent of taxpayers will earn 1 million or more in 2022 this exclusive club will receive 702 percent of all long-term capital gains and 433 percent of all dividends.

One of the changes announced was in April 2018. Currently long-term capital gains LTCG which was was introduced with effect from 1 April 2019 on listed equities held for more than a year is taxed at 10 percent on profits above a threshold of Rs 1 lakh. Finance Minister Paschal Donohoe has announced changes to the Capital Gains Tax Entrepreneur Relief in todays Budget.

But the thresholds are to be frozen between 2022 and 2026 meaning. On top of this the administration is aiming to increase the long-term capital gains tax rate up to 396 for taxpayers that have an income above 1 million. Fact Sheet Wealthiest King County residents would claim 23 of.

If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Heirs could then sell the asset free of capital-gains tax.

On May 28 th Bidens budget revealed plans to raise the marginal income tax rate up from 37 to 396. Today the House Budget Committee released a report on the need to enact fiscal policies that provide targeted relief to working Americans and small businesses while our nation grapples with and recovers from the coronavirus pandemic. September 15 2021 455 PM MoneyWatch.

This addresses a long-standing demand of new-age companies. Under the changes the ordinary share holding requirement so that a person.

Ranking Member S News Newsroom The United States Senate Committee On Finance

Senate Revenue Package Is Sound Policy Center On Budget And Policy Priorities

The Capital Gains Tax And Inflation Econofact

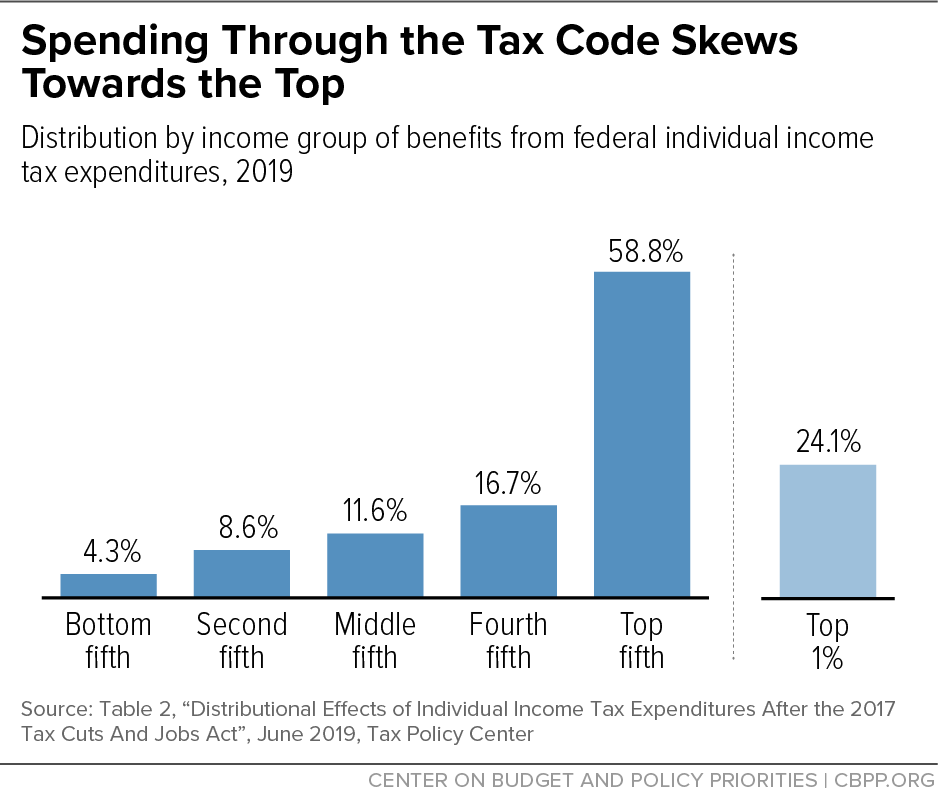

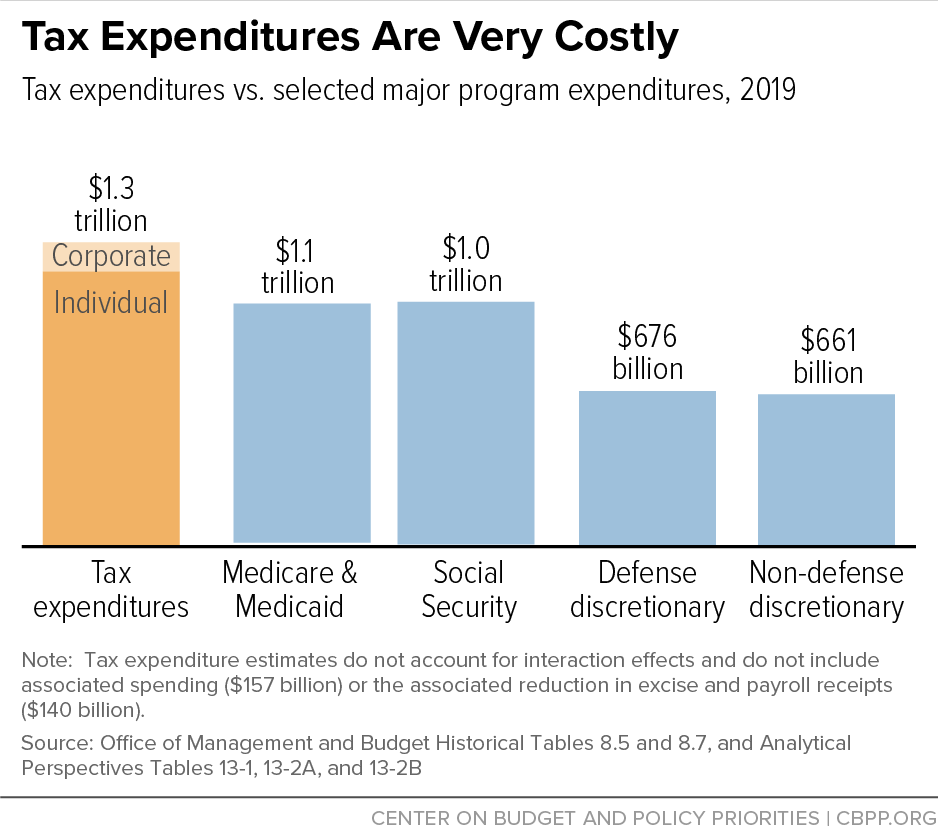

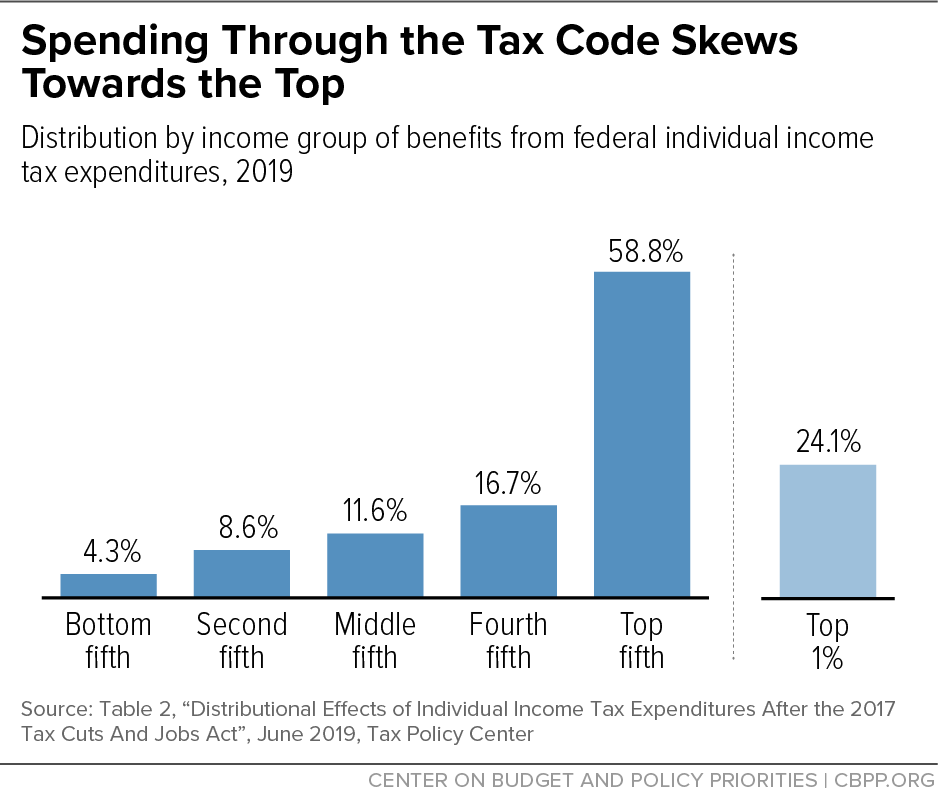

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

The Long And Short Of Capitals Gains Tax

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

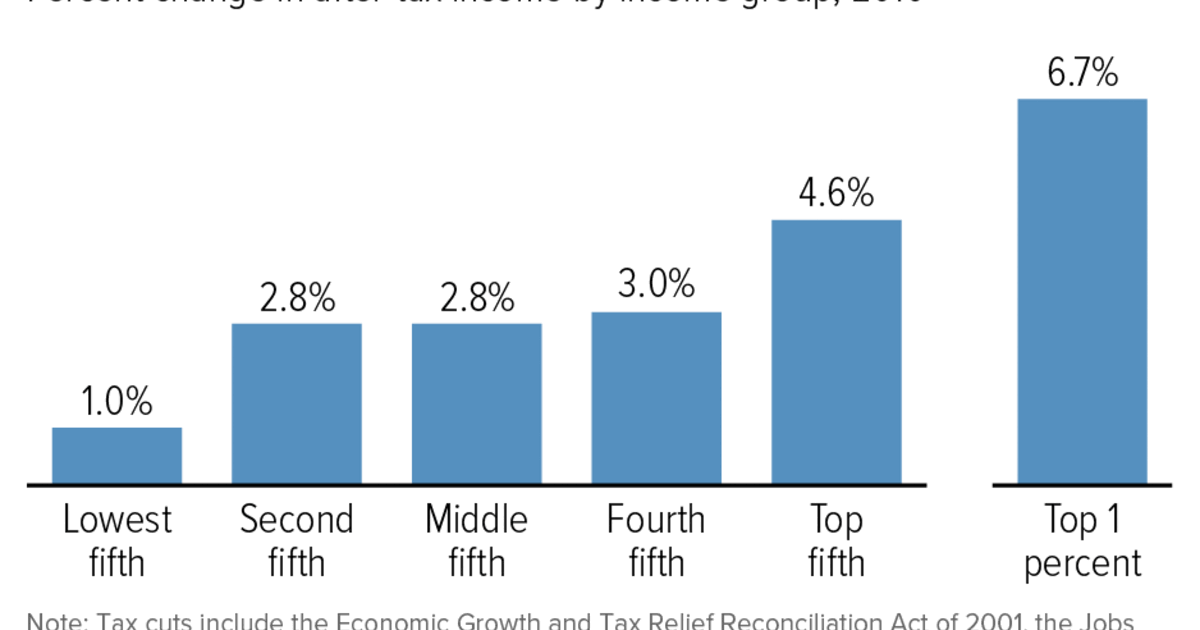

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

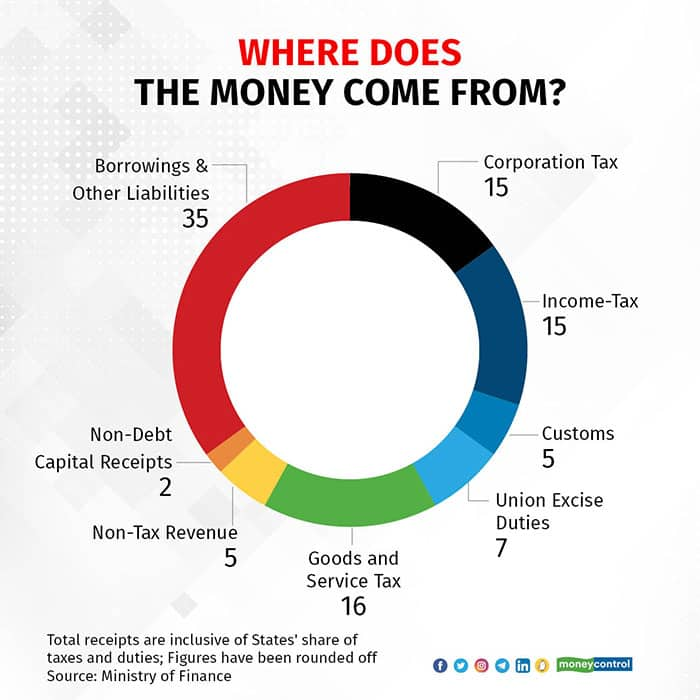

Understanding Union Budget 2022 Through Five Easy Graphs

The Long And Short Of Capitals Gains Tax

Biden Budget Biden Tax Increases Details Analysis

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

Income Tax Change Ltcg Surcharge Capped At 15 What It Means For Taxpayers Mint

How To Save Capital Gain Tax On Sale Of Residential Property

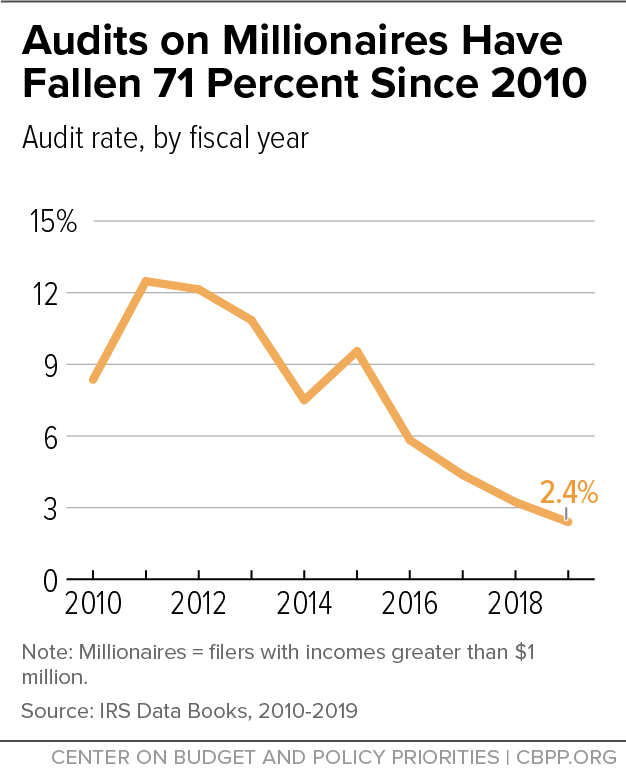

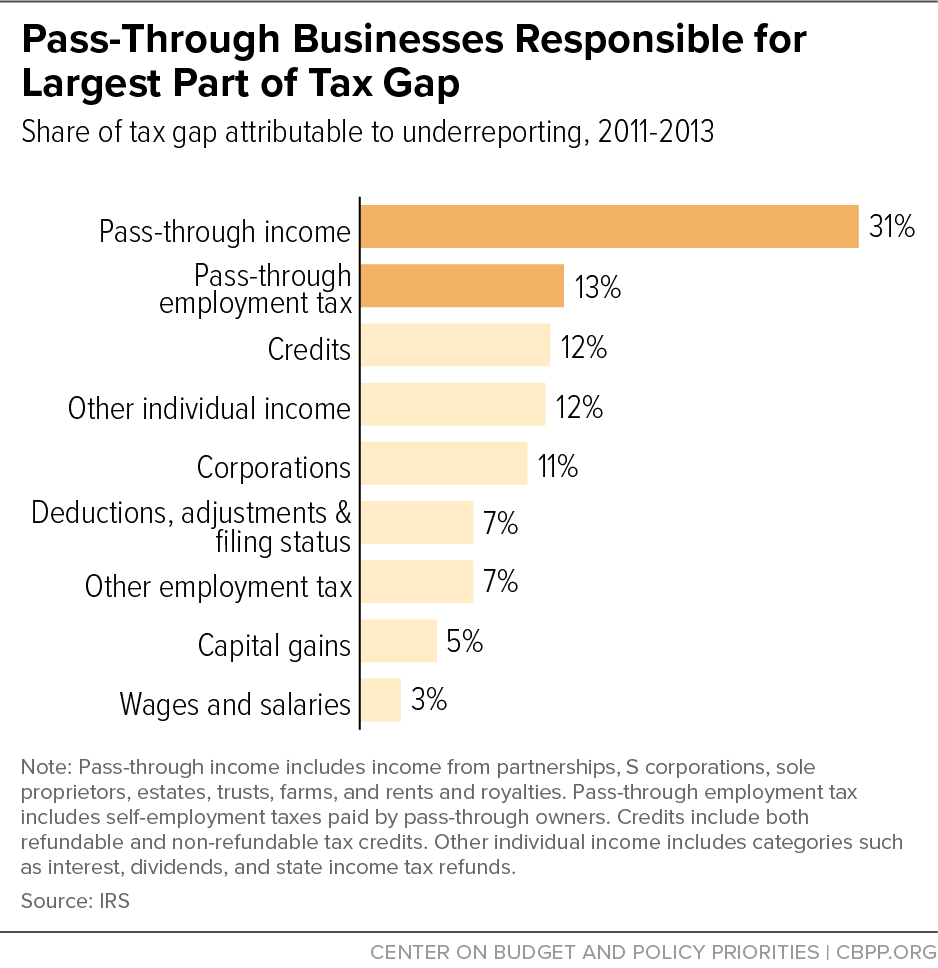

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Chart Book The Need To Rebuild The Depleted Irs Center On Budget And Policy Priorities